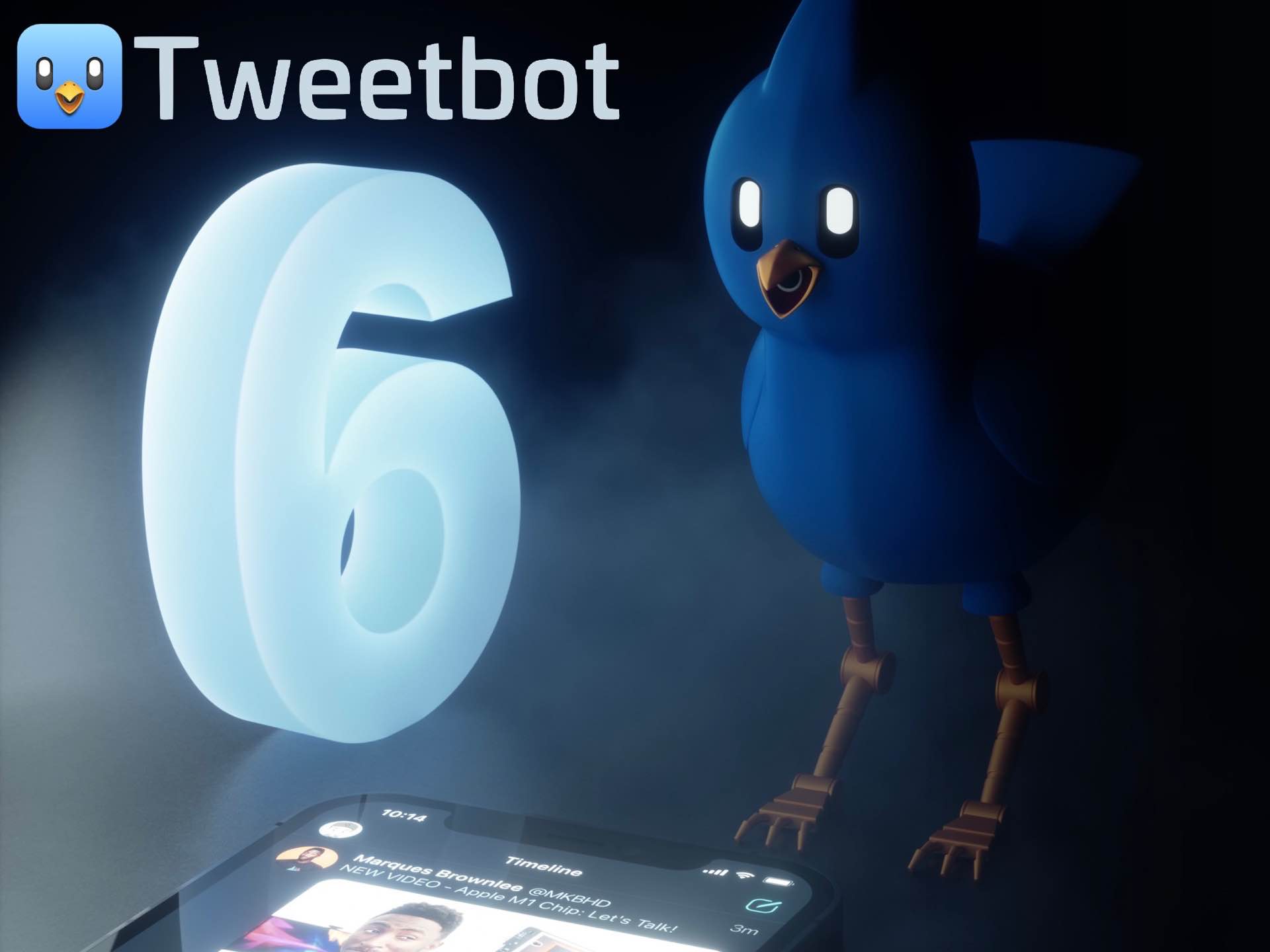

- #Tweetbot for twitter zip update

- #Tweetbot for twitter zip full

- #Tweetbot for twitter zip for windows 10

This includes replies from users that you do not follow, that is, if you are a public account. You will also receive a notification when a user follows you as well as heart, retweet, or replies to your post.

#Tweetbot for twitter zip update

This means your timeline will automatically update when the Twitter users you follow post a new tweet. The difference is that you can receive notifications while the program is running in the background.

#Tweetbot for twitter zip for windows 10

Twitter for Windows 10 offers the same functionality as the Twitter web app. This is the official Twitter application for Windows 10 computers but it is also compatible with the Windows 8 operating system. In addition to creating your own tweets, you can share other user’s tweets on your timeline. You can also post updates or tweets yourself so that your followers know what’s on your mind or what’s you’re busy with. Twitter for Windows 10 is suitable for active Twitter users that want to receive the latest updates from their local and international news outlets, celebrities, friends, family, and so on. “Ally Financial Inc.Twitter now offers its microblogging and social networking service as a desktop application. “The number of people losing their cars to repossession rose 11% in 2022 but remains below prepandemic levels (so far)” “2021 was a bit of the Wild West in the auto market,” Those buyers are sticking lenders with bigger losses when they fall behind” “Borrowers who took out big loans at the height of the boom owe far more than their vehicles are worth. “If job losses increase, many more consumers might find themselves unable to keep up with the record amounts of debt they took out in recent years” “Stress in the auto-loan market is concentrated among borrowers with credit scores below 660 and is especially high among people with bottom of the barrel credit. “Many borrowers took out large loans to buy (uses cars), leaving little breathing room to keep up with payments if they hit a rough patch”

“The past few years have been unusually good for consumers, (and Fintechs) who stowed away extra money during the pandemic, but sky-high inflation is eating away at those gains.” “… 9.3% of auto loans extended to people with low credit scores were 30 or more days behind on payments at the end of last year, the highest share since 2010.” ex Moody’s “Borrowers with low credit scores fall behind in numbers unseen since 2010” Yet a rising number of Americans are falling behind on their car payments” economy is on a steady footing and the unemployment rate is superlow. This time round as debt levels are so high it will not take major unemployment to cause issues - interest rates are doing this and with more rate rises its all trouble ahead This will add another challenge on top of inflation, interest rates, lack of funding and the economy Most Fintech’ target consumers and businesses who are credit challenged, these groups are the first to see pressure when lending turns sourĪuto lending is one of the leading indicators of trouble ahead

#Tweetbot for twitter zip full

Its now past the point of red warning flags for Fintech, its full red flashing lights – when auto arrears move it’s a precursor of more trouble ahead FINTECH – Red Warning Lights are Flashing!

0 kommentar(er)

0 kommentar(er)